With costs escalating, developing nations say commitment of USD100 billion is not enough

New Delhi: India and the US on Friday agreed to work towards a new global finance target, also known as the new collective quantified goal (NCQG), a report in The Tribune, Chandigarh, says

Developing countries say the corpus fund should be in trillions keeping in mind the growing costs of addressing and adapting to climate change.

“We also agree to work together in arriving at a new collective quantified goal from a floor of USD100 billion annually for the post 2025 period, taking into account the needs and priorities of developing countries,’’ said the Indo-US joint statement at the end of the ninth India-US Economic and Financial Partnership meeting.

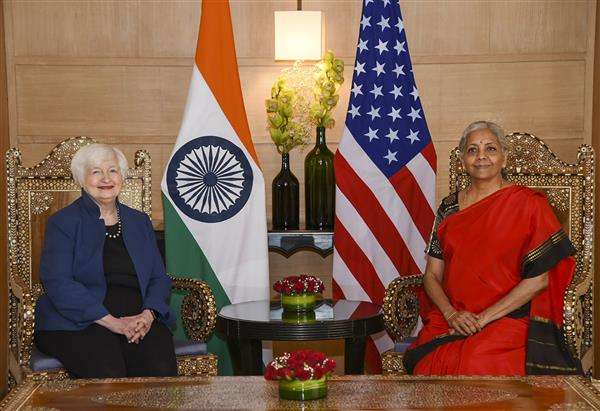

It was co-chaired by visiting US Treasury Secretary Janet Yellen and Union Finance Minister Nirmala Sitharaman. Given the regulatory overlaps, the meeting was also attended by US Federal Reserve Chair Jerome Powell and RBI Governor Shaktikanta Das.

The two sides agreed to pursue a broad mix of public and private financing to facilitate India’s energy transition in line with its nationally determined climate goals and capabilities.

The subject is also being discussed threadbare at the ongoing COP 27 in Egypt and will be tackled under the G20 Sustainable Finance Working Group with US as the co-chair and India holding the G20 Presidency next year.

The meeting also featured a dedicated session on climate finance.

The two sides also held productive discussions on a range of subjects, including the macroeconomic outlook, supply chain resilience, climate finance, multilateral engagement, global debt vulnerabilities, anti-money laundering and combating the financing of terrorism.

Regarding the Ukraine conflict they discussed the increased commodity and energy prices as well as supply disruptions.

Both countries will continue to work to enhance sharing of information to tackle offshore tax evasion and made note of the progress made under the Inter-Governmental Agreement pursuant to the Foreign Account Tax Compliance Act (FATCA) to share financial account information.

The two sides are also collaborating through continued technical support for the issuance of municipal bonds for critical urban infrastructure improvements.

By David Solomon

*********************************************************************

Readers

These are extraordinary times. All of us have to rely on high-impact, trustworthy journalism. And this is especially true of the Indian Diaspora. Members of the Indian community overseas cannot be fed with inaccurate news.

Pravasi Samwad is a venture that has no shareholders. It is the result of an impassioned initiative of a handful of Indian journalists spread around the world. We have taken the small step forward with the pledge to provide news with accuracy, free from political and commercial influence. Our aim is to keep you, our readers, informed about developments at ‘home’ and across the world that affect you.

Please help us to keep our journalism independent and free.

In these difficult times, to run a news website requires finances. While every contribution, big or small, will makes a difference, we request our readers to put us in touch with advertisers worldwide. It will be a great help.

For more information: pravasisamwad00@gmail.com