The India Special edition, conducted in commemoration of the nation’s 75 years of independence, also involved audience polls, which revealed people’s belief in the Sensex rally and mutual funds

The Continental Group, a leading insurance intermediary and financial services provider in the GCC region, recently hosted an expert panel discussion titled ‘Investment Story of the Golden Decade’, where finance specialists factored in historical precedents and the geopolitical status quo to analyze India’s growth prospects. The India Special edition, conducted in commemoration of the nation’s 75 years of independence, also involved audience polls, which revealed people’s belief in the Sensex rally and mutual funds.

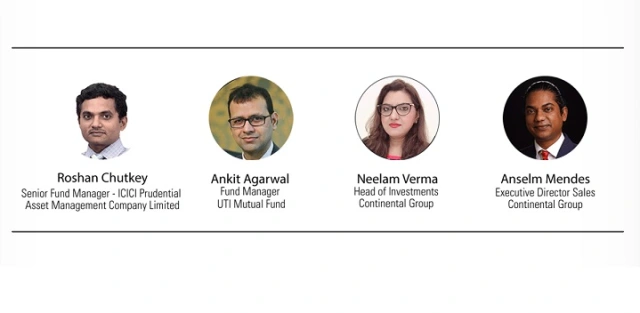

Roshan Chutkey, Senior Fund Manager ICICI Prudential AMC; Ankit Agarwal, Fund Manager, UTI Mutual Fund; and Neelam Verma, Vice President & Head of Investments, The Continental Group, were the key speakers at the webinar, which was hosted by Anselm Mendes, Executive Director of Sales, The Continental Group.

India’s unique position in the global value chain, its demographic dividend, and huge domestic demand, combined with externalities such as the China-Taiwan standoffs and the Ukraine-Russia conflict, are being increasingly factored in by global experts and research bodies in their economic forecasts. Despite widespread inflationary pressures and looming recession, there is upbeat sentiment among Indian investors, as evident from the audience poll (Webinar and LinkedIn channels), where 75% of respondents voiced confidence in Indian equity markets outperforming global indices.

“Indian economy is on course to 8–8.5% growth, as per high-frequency indicators. Reforms by the government — such as the concessional corporate tax rate — sound macroeconomic fundamentals, a highly digitized environment, the revival of the contact-based services sector, and enhanced CapEx by both public and private sectors are fortifying the economy, which is considerably resilient against recession due to its predominantly domestic nature. The next ten years are important in terms of how much India can harness its strengths such as good demographic dividend,” said Neelam Verma.

“The stimulus induced by the fed to combat pandemic pressures is now being drawn out, impacting economically weaker sections. RBI is managing through reserves but faces a policy dilemma in terms of interest rate hikes. Yet, there is cause for optimism due to digitalization-based architectures such as the UPI and ONDC, which can enhance the creditworthiness of SMEs through payables and balance sheet data. SMEs can give India’s exports the fillip to grow their global market share to, say, 2.5% and enable greater government spending,” opined Roshan Chutkey.

The foregone conclusion at this stage, according to Chutkey, is that exports must take the mantle and that they should be underpinned by digitalization and policy. Incidentally, a resounding 65% of the poll respondents recognized IT as the most favoured sector for investments. Echoing the export imperative, Ankit Agarwal said: “India churns out sizable skilled labour, which can supercharge services, manufacturing, and exports. The timing is right to undertake import substitution and backward integration, taking into account the broader shift away from China.”

“The repo rate increase will affect valuations of SMEs, which tend to require high working capital. Interest rate hikes will increase the cost of doing business. Meanwhile, however, Indian banks find themselves in a good position to lend. So, there is a clear case for credit-driven growth in India. The only detriment would be unfavourable policies,” Ankit added.

“Many Indian companies have set up manufacturing units for cement, building materials, textiles, engineering products, consumer electronics etc., either as joint ventures or in Special Economic Zones. The TATA Group has invested in the tourism, hospitality, catering, health, retail, and education sectors. Even Hinduja Group has set up manufacturing units for Ashok Leyland vehicles in Ras-al-Khaimah.”

— Neelam Verma, Vice President & Head of Investments

Despite volatilities in equity markets, Sensex breached the 60,000 mark recently, prompting investors to speculate its ability to reach 70,000 by the end of 2022. About 36% of respondents in the Continental Group’s poll expect Sensex to hit the mark, whereas 32% of the surveyed believe it will hover between 60,000 and 70,000.

Rationalizing the rally in stock markets, Neelam Verma said: “As we consider the interplay of economies and markets, we see compelling returns for goal-aligned portfolios of risk assets. Stocks look more attractive than bonds, which look more attractive than cash. Earnings growth is likely to drive equity markets across the developed world — and select economies like India from the emerging world — to new highs, and we think that continued strong growth and a higher-inflation environment will be a headwind to bonds. But given the potential cross-currents, we focus on balance within our broadly optimistic portfolio positioning and maintain an active approach.”

The audience poll also delved into cross-border investment trends, particularly within the context of non-resident Indians (NRIs) in the UAE. About 80% of NRI investors are still more inclined toward mutual funds (About 33% of respondents prefer dollar-denominated mutual funds in particular). From a trade standpoint, India is the UAE’s third largest partner. Following the CEPA between both countries, bilateral trade is set to grow to $100 billion in the next five years.

“Many Indian companies have set up manufacturing units for cement, building materials, textiles, engineering products, consumer electronics etc., either as joint ventures or in Special Economic Zones. The TATA Group has invested in the tourism, hospitality, catering, health, retail, and education sectors. Even Hinduja Group has set up manufacturing units for Ashok Leyland vehicles in Ras-al-Khaimah. These would not be possible without the cultural kinship between both nations — one that has persisted for centuries and grown since the unification of seven Emirates,” said Neelam Verma.

*********************************************************************

Readers

These are extraordinary times. All of us have to rely on high-impact, trustworthy journalism. And this is especially true of the Indian Diaspora. Members of the Indian community overseas cannot be fed with inaccurate news.

Pravasi Samwad is a venture that has no shareholders. It is the result of an impassioned initiative of a handful of Indian journalists spread around the world. We have taken the small step forward with the pledge to provide news with accuracy, free from political and commercial influence. Our aim is to keep you, our readers, informed about developments at ‘home’ and across the world that affect you.

Please help us to keep our journalism independent and free.

In these difficult times, to run a news website requires finances. While every contribution, big or small, will makes a difference, we request our readers to put us in touch with advertisers worldwide. It will be a great help.

For more information: pravasisamwad00@gmail.com