PRESS RELEASE

-

Highest full year operating and net profits in the Group’s history as robust demand for air travel drives record passenger revenue and load factors

-

Geopolitical tensions, macroeconomic uncertainties, inflationary pressures, and supply chain constraints pose challenges for the aviation industry

-

The SIA Group’s robust foundations and long-term strategic initiatives position it strongly to capture future growth opportunities

-

Proposed final dividend of 38 cents per share results in a total payout of 48 cents per share for FY2023/24, or a dividend yield of 7.5%1

The demand for air travel remained buoyant throughout FY2023/24, boosted by a rebound in North Asia as China, Hong Kong SAR, Japan, and Taiwan fully reopened their borders. SIA and Scoot carried a combined 36.4 million passengers, up 37.6% year-on-year. Passenger traffic grew 26.6%, outpacing the capacity expansion of 22.9%. As a result, the Group passenger load factor (PLF) improved 2.6 percentage points to a record 88.0%. SIA and Scoot registered record PLFs of 87.1% and 91.2% respectively.

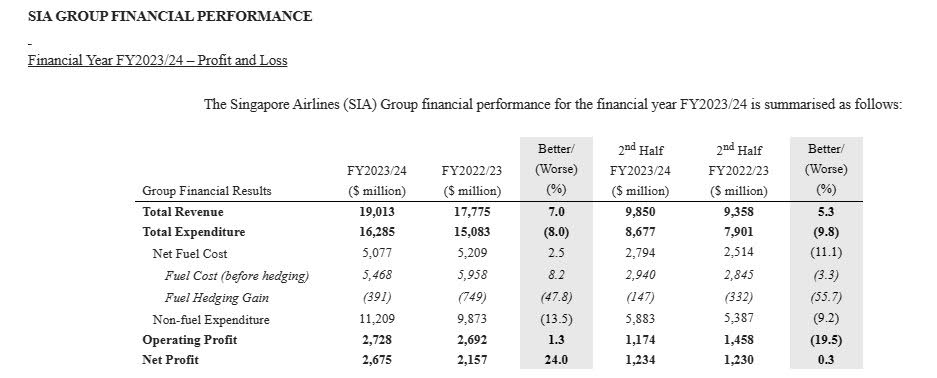

Group revenue rose $1,238 million (+7.0% year-on-year) to a record $19,013 million. Passenger flown revenue rose by $2,319 million (+17.3%) to $15,685 million, despite a 7.6% decline in passenger yields. Cargo flown revenue fell $1,485 million (-41.2%) to $2,119 million. While cargo loads increased by 1.7% due to the strong demand from the e-commerce segment, yields were 42.2% lower year-on-year – albeit 29.8% above pre-pandemic levels2.

Group expenditure increased $1,202 million (+8.0%) to $16,285 million. Non-fuel expenditure rose by $1,336 million (+13.5%), and was partially offset by a $132 million decrease (-2.5%) in net fuel cost. The increase in non-fuel expenditure was lower than the 16.0% increase in overall passenger and cargo capacity. On the other hand, net fuel cost fell despite higher volumes uplifted (+$918 million) and a lower fuel hedging gain (+$358 million), mainly due to an 18.5% decrease in fuel prices (-$1,281 million).

As a result, Group operating profit reached a record $2,728 million, up $36 million or 1.3% from a year before.

The Group’s net profit improved by $518 million (+24.0%) to $2,675 million. This was mainly due to the better operating performance (+$36 million), a net interest income versus net finance charges a year before (+$215 million), lower tax expense (+$132 million)3, and a share of profits versus a share of losses of associated companies from the previous year (+$104 million).

SECOND HALF FY2023/24 – PROFIT AND LOSS

Second half Group revenue rose by $492 million (+5.3%) year-on-year to $9,850 million, marking a record for the Group’s half-yearly revenue. This was driven by a $749 million (+10.1%) increase in passenger flown revenue on the back of a 17.5% growth in traffic, which was slightly below the 17.7% expansion in capacity. The Group PLF remained almost flat at 87.3% (-0.1 percentage point). Passenger yields declined 6.0% on intensifying competition as other airlines progressively restored capacity.

Cargo revenue fell $446 million (-29.7%), with yields declining (-35.9%) amid the recovery in bellyhold cargo capacity. This was partly offset by an increase in loads (+9.7%) due to robust e-commerce flows. The demand for air freight from Asia was also supported by security concerns in the Red Sea, bolstering the overall cargo performance.

Expenditure grew $776 million (+9.8%), consisting of a $496 million increase (+9.2%) in non-fuel expenditure and a $280 million increase (+11.1%) in net fuel cost. Net fuel cost increased to $2,794 million, mainly due to higher volume uplifted (+$365 million) and lower fuel hedging gain (+$185 million), and partially offset by a 6.8% drop in fuel prices (-$219 million).

In the second half, the Group operating profit decreased by $284 million (-19.5%) from the previous year to $1,174 million. The Group net profit was stable, rising $4 million year-on-year to $1,234 million. This was mainly driven by a lower tax expense (+$249 million) and a surplus on disposal of aircraft, spares, and spare engines versus a loss the year before (+$45 million), which offset the decline in operating performance.

Balance Sheet

As of 31 March 2024, the Group shareholders’ equity was $16.3 billion, down $3.5 billion from 31 March 2023. This was due to the partial redemption in June and December 2023 of the June 2021 Mandatory Convertible Bonds (MCBs) for $5.1 billion, including accrued yield. Total debt balances decreased by $1.9 billion to $13.4 billion, mainly due to the repayment of borrowings. As a result, the Group’s debt-equity ratio increased from 0.77 times to 0.82 times.

Cash and bank balances decreased by $5.1 billion to $11.3 billion, arising from the redemption of the MCBs, repayment of borrowings, and payment of dividends. This was mitigated by the $5.1 billion of net cash generated from operations, which included proceeds from forward sales. On top of the cash on hand, the Group has access to $2.9 billion of committed lines of credit, all of which remain untapped at present.

***********************************************************

Readers

These are extraordinary times. All of us have to rely on high-impact, trustworthy journalism. And this is especially true of the Indian Diaspora. Members of the Indian community overseas cannot be fed with inaccurate news.

Pravasi Samwad is a venture that has no shareholders. It is the result of an impassioned initiative of a handful of Indian journalists spread around the world. We have taken a small step forward with the pledge to provide news with accuracy, free from political and commercial influence. Our aim is to keep you, our readers, informed about developments at ‘home’ and across the world that affect you.

Please help us to keep our journalism independent and free.

In these difficult times, running a news website requires finances. While every contribution, big or small, will make a difference, we request our readers to put us in touch with advertisers worldwide. It will be a great help.

For more information: pravasisamwad00@gmail.com