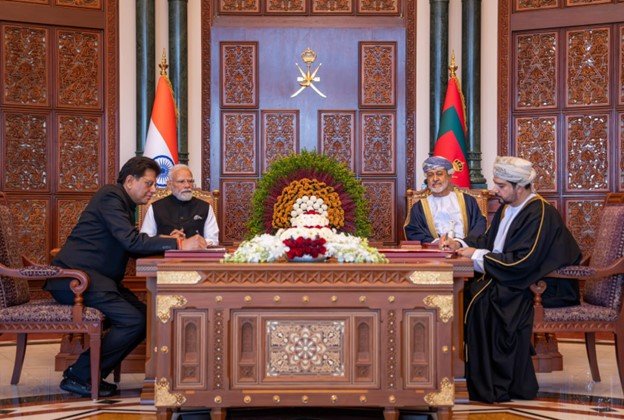

Increased scrutiny by India’s Enforcement Directorate could slow down the surge of Indian investors purchasing properties in Dubai

Dubai’s housing market has seen substantial growth, driven in large part by Indian investors, including those from smaller cities. As a result, Dubai became the world’s third-best-performing location for prime real estate in 2024, with a 16.9% increase, according to the Knight Frank Cities Index. While the majority of demand comes from high-net-worth individuals (HNIs), people from Tier 2 and Tier 3 Indian cities are increasingly purchasing properties in Dubai, reported economictimes.indiatimes.com.

Enforcement Directorate’s investigation into suspicious transactions is causing a slowdown in Dubai property investments

The Enforcement Directorate (ED), India’s agency that investigates money laundering, has become interested in these foreign investments. Armed with data from the Income Tax Department and Reserve Bank of India (RBI), the ED has initiated probes into suspicious purchases by Indians in Dubai, potentially slowing down this real estate shopping spree. During the October-December 2024 quarter, Dubai’s residential market reported a slight decrease in transaction numbers, with further decline expected due to ongoing investigations.

Why Indians from smaller cities are investing in Dubai’s property market

Property developers in Dubai are seeing increased inquiries from Indian residents of Tier 2 and Tier 3 cities.

With property prices in cities like Delhi and Mumbai skyrocketing, many are considering Dubai as an attractive alternative

According to Akash Puri, Director of International at India Sotheby’s International Realty, property values in India have surged by 60% over the past five years, making Dubai an appealing investment destination due to its favorable tax structure. Dubai’s tax-free environment, free from capital gains and income tax, stands in stark contrast to India’s tax regime.

Foreign Exchange Management Act (FEMA) regulations raise concerns for potential buyers

Despite Dubai’s appeal, buyers must navigate India’s Foreign Exchange Management Act (FEMA), which governs international property transactions. Transactions that involve payments in installments for properties in Dubai may come under scrutiny as they potentially violate FEMA regulations. As Siddharth Banwat, partner at S Banwat & Associates LLP, explains, individuals purchasing property on deferred payments need prior approval from the RBI. These regulations are a significant consideration for prospective buyers.

ED’s crackdown could impact the Dubai property market, but its appeal remains strong

As the ED continues its investigations into Indian property transactions in Dubai, experts expect a short-term slowdown in investment. However, Dubai’s combination of tax benefits, high rental yields, and property value still makes it an attractive destination for Indian investors, particularly those seeking better returns compared to India’s major metros.

***********************************************************

Readers

These are extraordinary times. All of us have to rely on high-impact, trustworthy journalism. And this is especially true of the Indian Diaspora. Members of the Indian community overseas cannot be fed with inaccurate news.

Pravasi Samwad is a venture that has no shareholders. It is the result of an impassioned initiative of a handful of Indian journalists spread around the world. We have taken a small step forward with the pledge to provide news with accuracy, free from political and commercial influence. Our aim is to keep you, our readers, informed about developments at ‘home’ and across the world that affect you.

Please help us to keep our journalism independent and free.

In these difficult times, running a news website requires finances. While every contribution, big or small, will make a difference, we request our readers to put us in touch with advertisers worldwide. It will be a great help.

For more information: pravasisamwad00@gmail.com