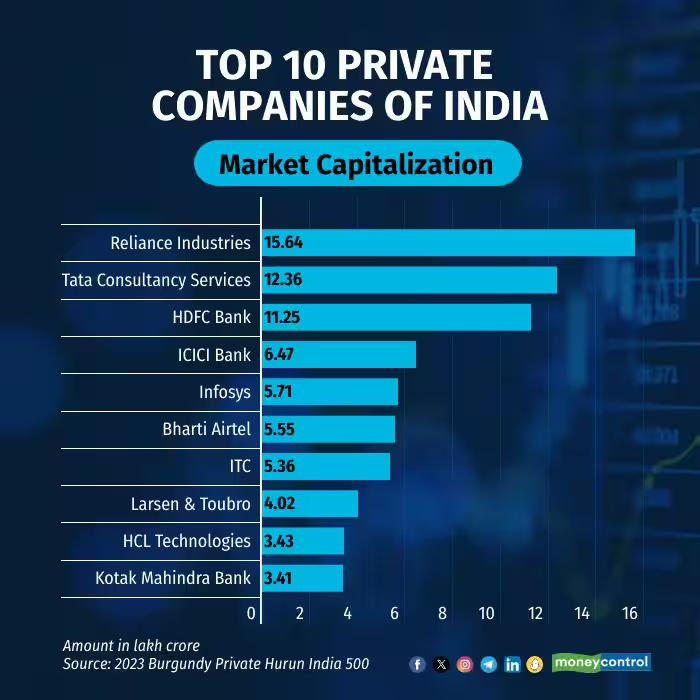

Reliance Industries leads the list, followed by TCS, HDFC Bank, and Bharti Airtel

Hurun India has unveiled the 2024 Burgundy Private Hurun India 500 list, ranking the country’s top 10 most valuable companies. The list, dominated by Reliance Industries, features three technology firms and a telecom giant. Together, these companies boast a combined market value exceeding the GDP of Saudi Arabia, reported timesofindia.indiatimes.com.

Market value surge surpasses Rs 96 lakh crore

According to the report, the total valuation of these top companies has risen by Rs 22.7 lakh crore, reaching Rs 96 lakh crore—almost one-third of India’s GDP. Reliance Industries, led by Mukesh Ambani, retains its position at the top with a valuation of Rs 17,52,650 crore. Tata Consultancy Services (TCS), helmed by K. Krithivasan, follows closely with a valuation of Rs 16,10,800 crore. Bharti Airtel, under Gopal Vittal’s leadership, has witnessed the highest absolute increase in value, adding over Rs 4 lakh crore to its market cap in 2024.

Tech companies dominate the rankings with significant growth

-

TCS holds the second position with a 30% year-on-year increase in market capitalization, reaching Rs 16,10,800 crore

-

Infosys, ranked sixth, has grown by 40% to Rs 7,99,400 crore, while HCL Technologies, in ninth place, recorded the highest yearly increase among tech firms at 51%, reaching Rs 5,18,170 crore

“The companies featured in the 2024 Burgundy Private Hurun India 500 list represent the backbone of India’s private sector, driving economic growth and innovation. Collectively, they hold a valuation of $3.8 trillion—exceeding India’s annual GDP—and employ 8.4 million people,” said Anas Rahman Junaid, founder and chief researcher at Hurun India.

“If you want to understand the trajectory of India’s economic growth, studying the stories behind these most valuable companies is key,” Junaid added.

Top 10 Most Valuable Indian Companies in 2024

Company Market Capitalization (Rs) Increase (%)

Reliance Industries 17,52,650 crore 12%

Tata Consultancy Services 16,10,800 crore 30%

HDFC Bank 14,22,570 crore 26%

Bharti Airtel 9,74,470 crore 75%

ICICI Bank 9,30,720 crore 44%

Infosys 7,99,400 crore 40%

ITC 5,80,670 crore 8%

Larsen & Toubro 5,42,770 crore 35%

HCL Technologies 5,18,170 crore 51%

National Stock Exchange of India 4,70,250 crore 201%

***********************************************************

Readers

These are extraordinary times. All of us have to rely on high-impact, trustworthy journalism. And this is especially true of the Indian Diaspora. Members of the Indian community overseas cannot be fed with inaccurate news.

Pravasi Samwad is a venture that has no shareholders. It is the result of an impassioned initiative of a handful of Indian journalists spread around the world. We have taken a small step forward with the pledge to provide news with accuracy, free from political and commercial influence. Our aim is to keep you, our readers, informed about developments at ‘home’ and across the world that affect you.

Please help us to keep our journalism independent and free.

In these difficult times, running a news website requires finances. While every contribution, big or small, will make a difference, we request our readers to put us in touch with advertisers worldwide. It will be a great help.

For more information: pravasisamwad00@gmail.com